How Long Is the Payback Period If I Invest in a Blow Molding Line?

Tabla de contenido

- 1. The “Outsourcing Premium” vs. Manufacturing Cost

- 2. Energy: The Hidden Cost That Kills ROI

- 3. The Cost of Waiting (Lead Times and Lost Sales)

- 4. Uptime: Why “Cheap” Machines Are Actually Expensive

- 5. Cap-Ex: Getting More Machine for Less Money

- 6. Calculating Your Own Payback Period (Free Tool)

- Conclusion: It’s About Total Cost of Ownership

Let’s be honest. Buying industrial machinery is expensive.

If you are a growing business, this might be your first major capital equipment purchase. Writing a check for hundreds of thousands of dollars is scary. It keeps you up at night. You aren’t just asking, “How much does this machine cost?”

You are asking the real question: “When will I get that money back?”

In the socio de fabricación world, we call this the ROI (Return on Investment) or the payback period.

For most efficiency-focused factories, the “magic number” to approve a purchase is usually under 3.5 years. If the machine pays for itself in that time, it is considered a smart buy.

But here is the good news.

If you choose the right equipment and optimize your energy usage, you can often see a full payback in 18 to 24 months.

I have helped many CPG brands and factories run these numbers. Here is how the math actually works for Extrusión Soplado (MBE) machines.

1. The “Outsourcing Premium” vs. Manufacturing Cost

If you are currently buying your botellas from an outside supplier, you are paying a premium. You aren’t just paying for the plastic. You are paying for:

- The supplier’s profit margin.

- The supplier’s inefficient, old machines.

- The shipping costs to get empty air (bottles) to your factory.

- The cost of their slow lead times.

We call this the “Outsourcing Premium.”

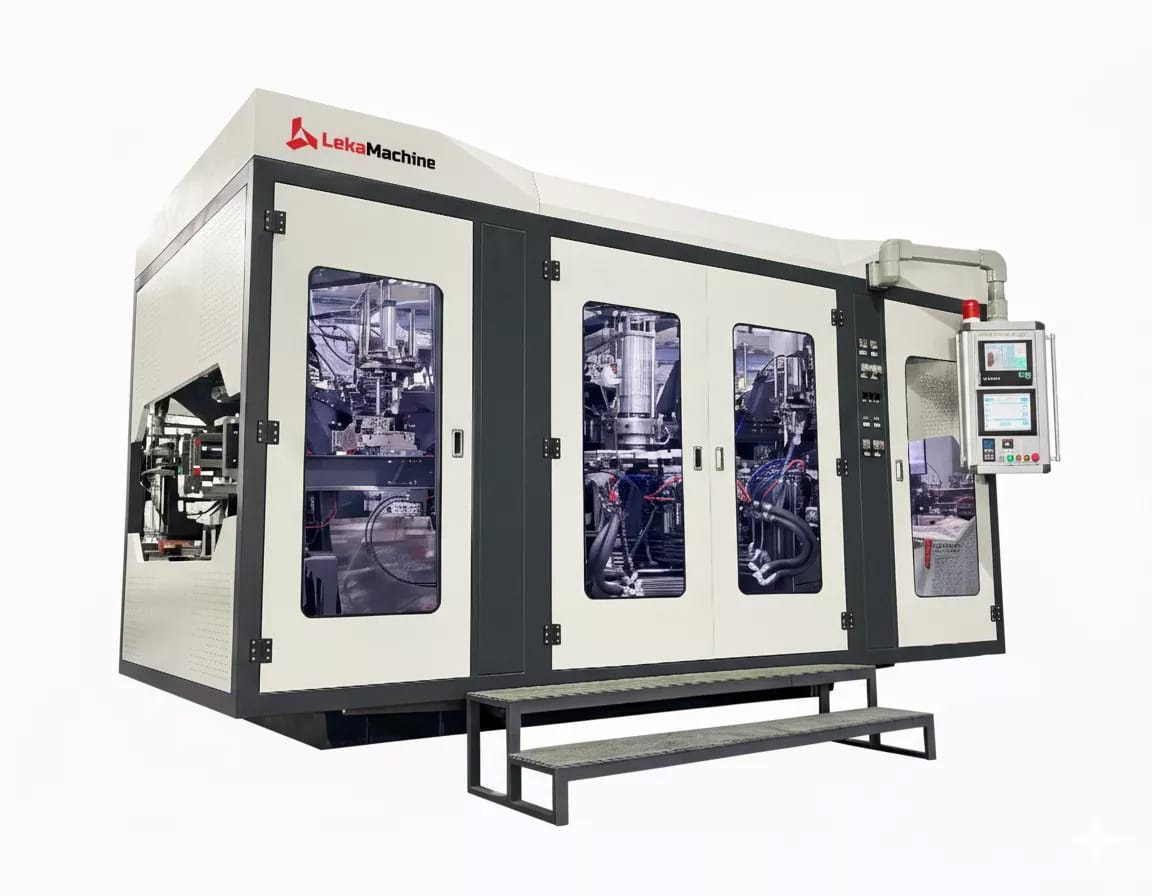

When you bring production in-house with your own Máquina de moldeo por extrusión-soplado, you eliminate these extra costs immediately. You take control of your supply chain.

Let’s look at the target numbers.

When my clients switch from buying bottles to making them, we typically aim to reduce the cost per container by 6 to 8 cents. This savings includes the cost of resina plástica, energy, and even the labor to run the machine.

That might sound like small change, but it adds up fast.

Let’s say you produce 10 million bottles a year.

- Savings per bottle: $0.06

- Annual Volume: 10,000,000

- Total Profit Increase: $600,000

That is $600,000 in pure profit added straight to your bottom line in just the first year. For many of our mid-sized machines, like the Serie FORMA, that savings alone covers a huge chunk of the machine’s price tag in year one.

You are no longer bleeding margin to a supplier. You are keeping it.

2. Energy: The Hidden Cost That Kills ROI

Many first-time buyers make a classic mistake. They only look at the sticker precio de la máquina.

They think, “This machine is $50,000 cheaper, so my payback period will be faster.”

Often, the opposite is true. This is because of energy costs.

In the bottle socio de fabricación world, your electricity bill is not just a utility expense. It is a major ingredient cost. Electricity can make up 15% to 30% of the cost of every single container you produce.

If you buy an older style or inefficient hydraulic machine, it will eat up your profits every month.

- The Old Standard: Traditional hydraulic moldeo por soplado often consume between 0.35 and 0.50 kWh of electricity for every kilogram of plastic processed.

- El nuevo estándar: To get a fast ROI, you need a machine that targets ≤0,22 kWh/kg.

Let’s put that in perspective. If you are running a high-volume line in a region where energy costs are rising by 6-10% a year (like in many parts of the Americas or Europe), an inefficient machine is a liability. It is like driving a car that burns gas twice as fast as it should.

At LEKAmachine, we focus heavily on Costo Total de Propiedad (CTP). Our Serie AERO uses optimized drive systems to keep energy consumption low.

Saving 30% on your energy bill every month pays off the machine much faster than saving a few dollars on the initial purchase price.

3. The Cost of Waiting (Lead Times and Lost Sales)

There is another cost that never shows up on an invoice, but it is very real. It is the cost of waiting.

I hear this complaint from CPG brands all the time: “I can’t launch new products quickly because my contract fabricante has long lead times.

When you rely on an outside factory, you are on their schedule. If you want to launch a new lotion bottle for a retail deal with Target or Whole Foods, you can’t afford to wait months for a production slot.

If you miss your launch window, you lose revenue.

Bringing production in-house gives you flexibility.

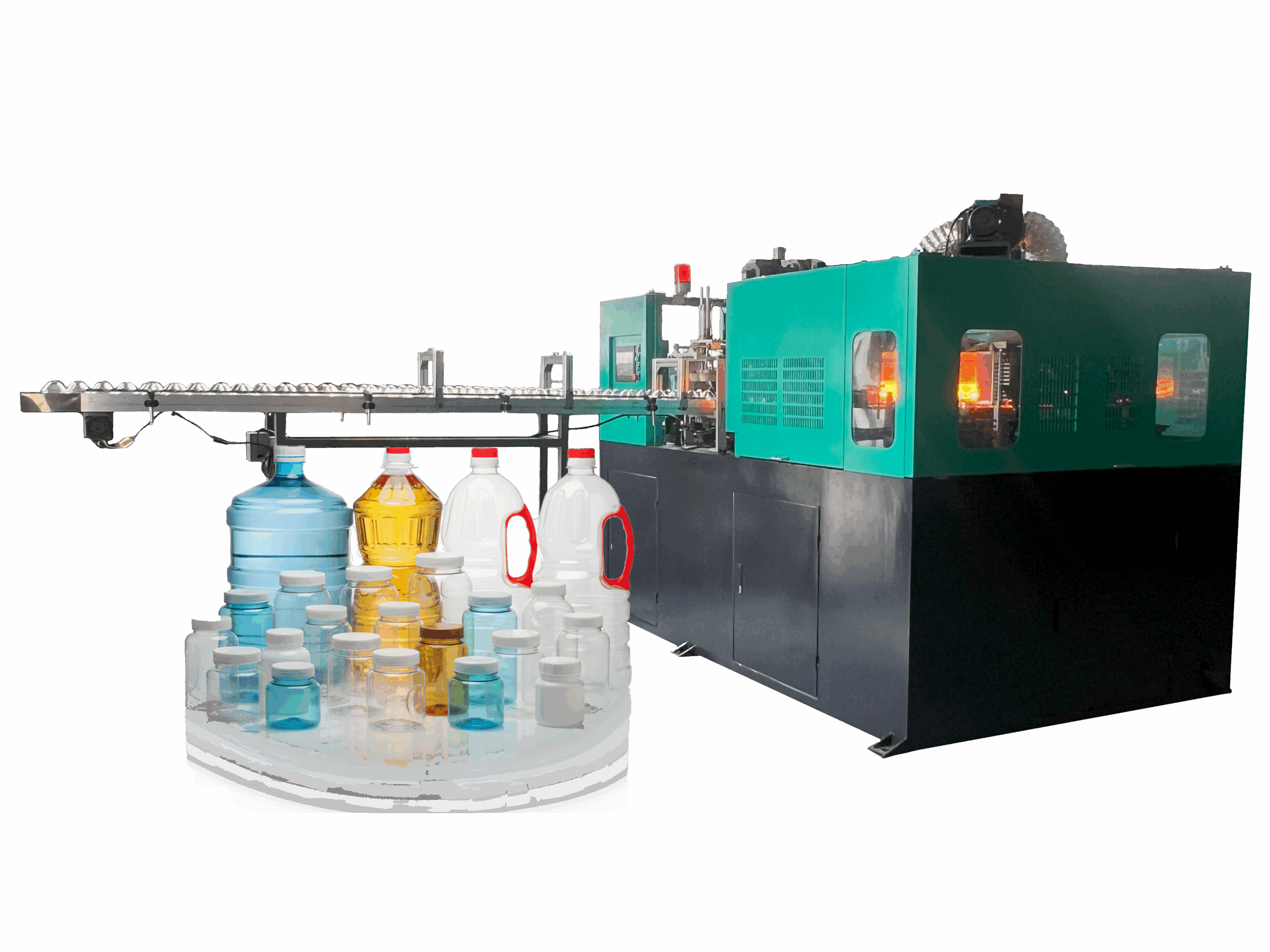

- Fast Changeovers: Modern machines allow you to swap molds quickly. The target is to do a hot mold swap in under 25 minutes. This means you can switch from making botellas de champú). to juice bottles in the same morning.

- Machine Delivery: Speed matters when buying the machine, too. Many European suppliers have very long waiting lists. We offer 60-90 day delivery times, which is a major advantage.

Getting your machine running 3 months earlier means you get 3 extra months of profit in your first year. That drastically shortens your payback period.

4. Uptime: Why “Cheap” Machines Are Actually Expensive

It is tempting to look for the cheapest machine on the market to save money upfront. But in manufacturing, a cheap machine often becomes the most expensive one you own.

Why? Because of downtime.

If your machine stops running, you stop making money.

- The Cost of a Stop: The average unplanned stop on a línea de montaje can last 2 to 4 hours.

- The Lost Product: On a high-speed line, every single hour the machine sits still, you could lose 12,000 to 25,000 bottles that should have been made.

If a “cheap” machine breaks down once a week, those lost bottles destroy your ROI calculation. Reliability is everything.

You need a machine that runs consistently. This is why we use trusted, high-quality components like Siemens PLCs como Festo pneumatics in our equipment. A machine that runs 24/7 pays for itself. A machine that needs constant repairs is a liability.

5. Cap-Ex: Getting More Machine for Less Money

Finally, we have to talk about the initial price tag, or “Cap-Ex” (Capital Expenditure).

A full línea de moldeo por extrusión y soplado is a strategic asset. The investment typically ranges from $450,000 to $1.6 million depending on the size and automation level.

This is where working with a smart manufacturing partner changes the math.

European machines are fantastic, but they come with a massive price premium. At LEKAmachine, we offer a significant advantage: 25% to 40% lower Cap-Ex compared to similar European options.

The math here is simple. If your initial investment is 30% lower, but your output speed and bottle calidad are the same, your payback period shrinks by months or even a full year. You get to the “profit zone” much faster.

6. Calculating Your Own Payback Period

You can do a quick estimate on the back of a napkin right now using a simple formula:

Total Investment ÷ [ (Cost to Buy – Cost to Make) x Annual Volume ] = Years to Payback

However, real manufacturing is more complex than a napkin sketch. You need to know exactly how cycle times, output rates, and bottle weights affect your bottom line.

To help you get precise numbers, we have built a dedicated tool:

Use the Extrusion Blow Molding Calculator »

How this calculator helps you define your solution:

- Define Your Output: It helps you calculate the exact “Pcs/Day” based on your bottle size, ensuring you don’t buy a machine that is too big (wasteful) or too small (bottleneck).

- Verify Cycle Times: Input your bottle weight and material to see realistic cycle time expectations.

- Plan Your Configuration: It clarifies the technical requirements, helping you choose between single-station or double-station machines before you even request a quote.

Using accurate data from the calculator will give you a much clearer picture of your ROI than guessing.

Conclusion: It’s About Total Cost of Ownership

When you are deciding to bring production in-house, don’t just look at the price tag of the machine.

Mira el Costo Total de Propiedad (CTP).

- Look at the energy savings.

- Look at the reliability.

- Look at the speed of delivery.

The lowest price isn’t always the best deal if the electric bill kills your margin.

At LEKAmachine, we help growth-stage brands and factories maximize these savings. We recommend starting with our online calculator to define your initial production parameters.

Are you ready to verify the numbers for your specific project?

Contact us today for a free, detailed ROI consultation.

0 Comentarios